The pharma sector is changing. According to a study by Pharmaceutical Technology the pandemic originated by COVID-19 has accelerated the digital transformation by more than 5 years. And of course, in 2023 the journey continues. Pharmaceutical companies are expected to continue developing online strategies with a focus on healthcare professionals and patients. Aware of this change, from the Life Science business area of ROI UP we want to serve as a loudspeaker to explain what this evolution of the pharmaceutical world in its shift towards the online ecosystem consists of.

The customer experience in the pharmaceutical sector: scores from the consulting firm DT

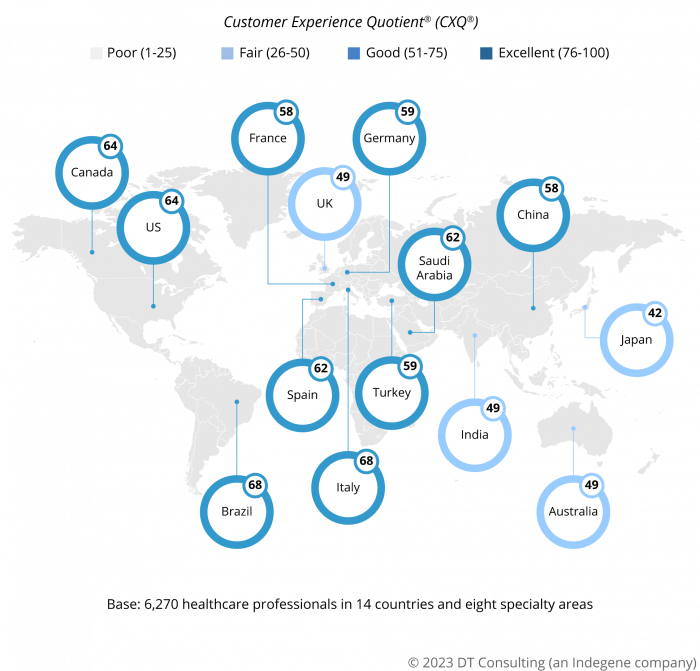

Customer experience (CX) analysis is one of the most accurate ways to measure the new digital changes that are beginning to be implemented. The British consultancy DT has been publishing studies on the subject since 2017. In 2022 it published The State Of Customer Experience In The Global Pharmaceutical Industry, 2022: HCP Interactions, a work in which they focus on the interactions between the pharmaceutical industry and healthcare professionals. It involved the participation of 6,270 professionals from the most relevant medical fields in Australia, Brazil, Canada, China, France, Germany, India, Italy, Japan, Saudi Arabia, Spain, Turkey, the United Kingdom, the United States and the United States. All of them evaluated their recent experiences with pharmaceutical companies. The resulting data are used to create the Customer Experience Quotient® (CXQ®) metrics, the scores of which are as follows:

- Poor: 1 to 25

- Regular: From 26 to 50

- Good: 51 to 75

- Excellent: 75 to 100

If we dig a little deeper into the report, these are the main conclusions:

Much remains to be done in the pharma sector

The overall customer experience score is generally good. The needs of healthcare professionals in the post-pandemic scenario are many and companies fail to meet them in full. Although the overall score of 59 out of 100 is not bad, it is far from excellence. In our specific case, Spain’s score is slightly above the global average, reaching 62 points.

Good level of CX in China

China is the second largest pharmaceutical market in the world. It is currently undergoing a notorious process of investment and strengthening of marketing and sales. Its score of 58 puts it on a par with Germany and France, two of the major European powers, and well above the worst performer on the list, Japan with a score of 42.

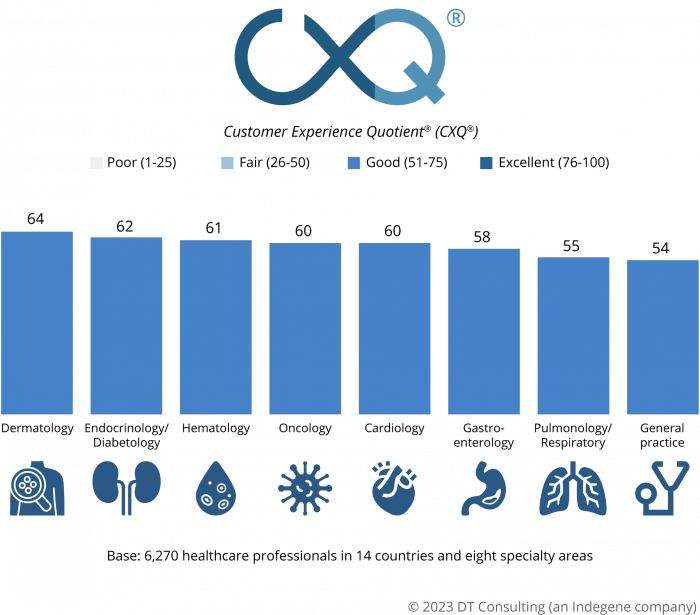

Dermatologists are the best treated by pharmaceutical companies

Specialists in skin disorders are the medical professionals who rate their interactions with pharma the highest, scoring them a 64. While all specialties rate their experiences well, general practitioners and pulmonologists give the lowest scores, 54 and 55, respectively.

How do physicians rate their interactions with pharmaceuticals?

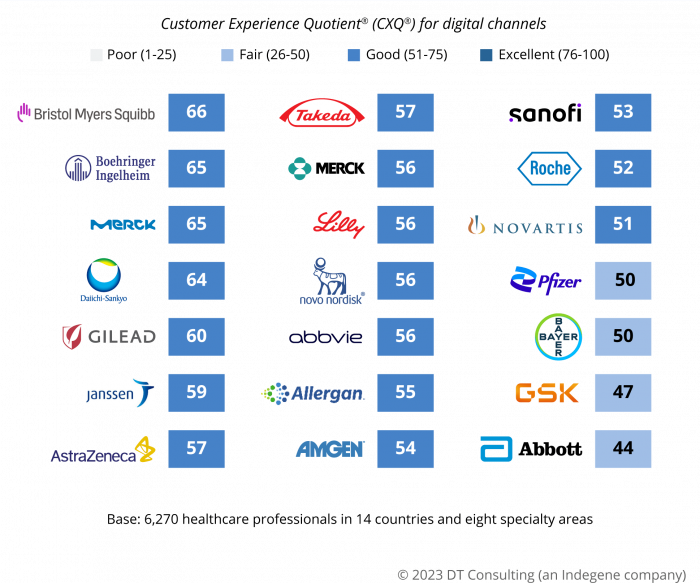

The major global pharmaceutical companies were submitted to the medical professionals in the study (AbbVie, Allergan, Amgen, Astellas, AstraZeneca, Bayer, Biogen, BioNTech, Boehringer Ingelheim, Bristol Myers Squibb, Celgene, Daiichi Sankyo, Eisai, Gilead, GlaxoSmithKline, Janssen, Lilly, Menarini, Merck, Merck & Co, Moderna, Novartis, Novo Nordisk, Pierre Fabre, Pfizer, Roche, Sanofi, Servier, Takeda, Teva, UCB, Viatris). Co, Moderna, Novartis, Novo Nordisk, Pierre Fabre, Pfizer, Roche, Sanofi, Servier, Takeda, Teva, UCB, Viatris).

None of them managed to achieve excellence (76-100 points), nor do any of them stand clearly above the rest. UCB, Gilead and Novo Nordisk are the leaders in overall customer experience. For digital customer experience, Bristol Myers Squibb, Boehringer and Merck are the group leaders. Finally, for non-digital channels, Novo Nordisk, Gilead and Pierre Fabre are the highest scoring companies.

The future of pharma will not be all-digital

Although by 2022, when the study was conducted, the restrictions caused by the pandemic had already been relaxed in most of the countries analyzed, it does not appear that interactions will return to the pre-2020 scenario, with face-to-face being the norm. Telematic meeting applications are here to stay. Other conclusions that were established were:

- The use of technology is valued. The direct videoconferences with industry representatives were very well rated, obtaining a score of 69, close to excellence.

- Physical events are back. Virtual events worked well in the pandemic. But in the current scenario for pharma it is more difficult to make them relevant and they are slowly returning to the real world.

- 100% digital channels are not well valued. Websites, mobile apps and online video are not rated at all well (48 overall). Only websites with registration that offer more personalized experiences are saved.

- Social networks fail. As a pharmaceutical information channel, social media have the worst score of all the activities measured (37). This is a very relevant fact that should be taken into account. ROI UP Group recently carried out a complete report on social networks in pharma in which we analyzed the type of communication developed by the 25 pharmaceutical companies with the highest turnover in Spain.

Contents: well rated but with hidden flaws

In general, the health professionals who participated in the study rated the information and services they receive from pharmaceutical companies highly. However, there are some perceived shortcomings that complicate the situation:

- Significant lack of clinical data. They are the information most in demand by healthcare professionals, but only half of the people surveyed said they had received them in the last few months.

- Common content with poorly rated experiences. Prescription and posology is information that is regularly provided and easily accessed. But when it is reduced to content solely delivered via digital media the score drops to low levels (45).

- Optimization of interactions is demanded. Healthcare professionals are very clear about the ideal frequency of contact with pharmacists: most of them no more than twice a month. It is therefore clear that they want this time to be of the highest possible quality.

- A lot of competition in customization aspects. Healthcare providers rate pharma’s personalization highly. The top performers are UCB, Novo Nordisk and Gilead which tie with 62 points, the next 10 are between 59 and 61, highlighting the need for improvements in differentiation between firms.

The pharmaceutical industry’s room for improvement

Each company must find its own balance between digital and offline channels and know how to adapt it to the particularities of each country. Data science and data interpretation should always be the basis for meeting customer needs. DT Consulting offers the following general recommendations:

Limit unwanted content

A lot of time is spent on content that is discarded by healthcare professionals. It is essential to discover the content that is really in demand in the way and at the frequency desired by the recipients. In this regard, on-demand channels offer the best performance.

Reconciling technology with physical interactions.

The hybrid model is constantly evolving. For this, it is essential to provide quality training for its representatives both in the digital world and in customer relationship models.

Predict new customer acquisition models.

Change is constant, so it is vital to fortify yourself with a solid database to predict the ever-changing preferences of healthcare professionals, both in terms of content and channels.

List of Social Media publications

- Were the best claims in history in their early days?

- A inteligência artificial nas redes sociais e nas relações públicas

- Artificial intelligence in social networks and PR

- We launch our 2023 social media observatory for the pharma sector

- Faster than the jewels of the Rally Clásico Mallorca

- Improve engagement in your social media strategy

- Digital Detox in times of confinement? Count me out

- Identity theft in social networks: what to do

- Young people, the new communication challenge for Real Estate (II)

- Instagram marketing strategies for businesses